Insurance in the Age of Digital Transformation

Insurers are increasingly challenged by unexpected business interruptions as they struggle to provide quality customer experience and drive profitability. Adopting the right data-driven technology in the age of digital transformation is crucial to property and casualty (P&C) insurance, life and non-life carriers, and payers alike to ensure a streamlined approach to claims processing, business optimization, rapid fraud detection, risk and loss assessment, and customer retention.

Fraud Detection

As fraudulent activities increase with time and technology, insurers must keep one-step ahead by deploying new anti-fraud tactics around predictive modelling, link analysis, exception reporting, and AI. Raw data arriving in PDF or text-based reports from clients and 3rd party systems can promote common schemes like double-payments, repeat claim submissions, premium and asset diversion, fee churning, and other types of fraud.

To combat fraud, Altair helps carriers:

- Automate the extraction and transformation of data from unstructured, siloed formats while easily applying advanced fraud detection techniques such as Benford’s Law or the Gestalt tests.

- Generate and deploy business rules to spotlight probable fraudulent activities.

- Model complex relationships between inputs, outputs, and find fraudulent patterns in large amounts of data.

Risk Assessment

From regulatory and policy changes to new liabilities, disruptive world events are altering risk assessment and loss analyses overnight, making it more important than ever to streamline underwriting and actuarial processes. Repeatable data transformation and machine learning and artificial intelligence (MLAI) represent a huge opportunity in determining general risk and that of new insurance applicants to ensure a sound investment.

- Compare disparate policy and claims data quickly and precisely, outside of parsing through Excel or semi-structured data.

- Compile siloed data sources that indicate and measure liability in a self-service, no code environment, eliminating manual, error-prone workflows.

- Apply predictive analytics to past loss trends to determine proper rates and reserves and overall planning of risk management.

No code data transformation for insurance, instantly make data ready.

Read How

RPA for Claims Processing and Reconciliation

As more businesses use robotic processing automation (RPA) to better operationalize and assess efficiency gaps, there are hurdles to fully realizing its benefits. Altair® Monarch® complements RPA initiatives by automating repeatable data transformation processes using models that ensure standardized report formats designed to meet end user requirements, drive out inefficiencies, and reduce costs and effort.

- Streamline data workflows and create shared, governed assets in preparation for further analysis, such as calculating premiums and targeting fraud.

- Implement RPA for claims comparison and auto-adjudication by blending data across claimants to uncover complex patterns, trends, and anomalies.

- Connect dozens of applications and databases across geographies and departments to minimize time spent on reconciliation and standardize financial reporting.

Customer Engagement and Retention

Digital transformation has forced carriers and agents to rapidly respond to customer expectations at every part of the insurance process. From shopping to on-demand service, customers now expect lightning-fast, personalized, and high-quality experiences. By leveraging repeatable data collation across all channels and user touchpoints, you can refine outreach initiatives and tailor policies to suit exact needs.

- Refine customer outreach and tailor policies to provide a personalized experience based on historic customer and demographic data and behavioral trends.

- Anticipate risk of cancellation through AI-backed insights of customer experiences and early identification of signs leading to churn.

- Test scenarios against changes in controllable and uncontrollable variables to deploy a strategy that reaches the right audience, with the right message, using the right channel.

- Anticipate the success of marketing campaigns by automating and repeating processes used in machine learning models.

Featured Resources

Guide to Using Data Analytics to Prevent Financial Fraud

Financial fraud takes countless forms and involves many different aspects of business including; insurance and government benefit claims, retail returns, credit card purchases, under and misreporting of tax information, and mortgage and consumer loan applications.

Combating fraud requires technologies and business processes that are flexible in their construct, can be understood by all who are involved in fraud prevention, and are agile enough to adapt to new attacks without needing to be rebuilt from scratch. Armed with advanced data analytics, firms and government agencies can identify the subtle sequences and associations in massive amounts of data to identify trends, patterns, anomalies, and exceptions within financial transaction data. Specialists can use this insight to concentrate their attention on the cases that are most likely fraud.

This guide will help you understand the complex environment of financial fraud and how to identify and combat it effectively.

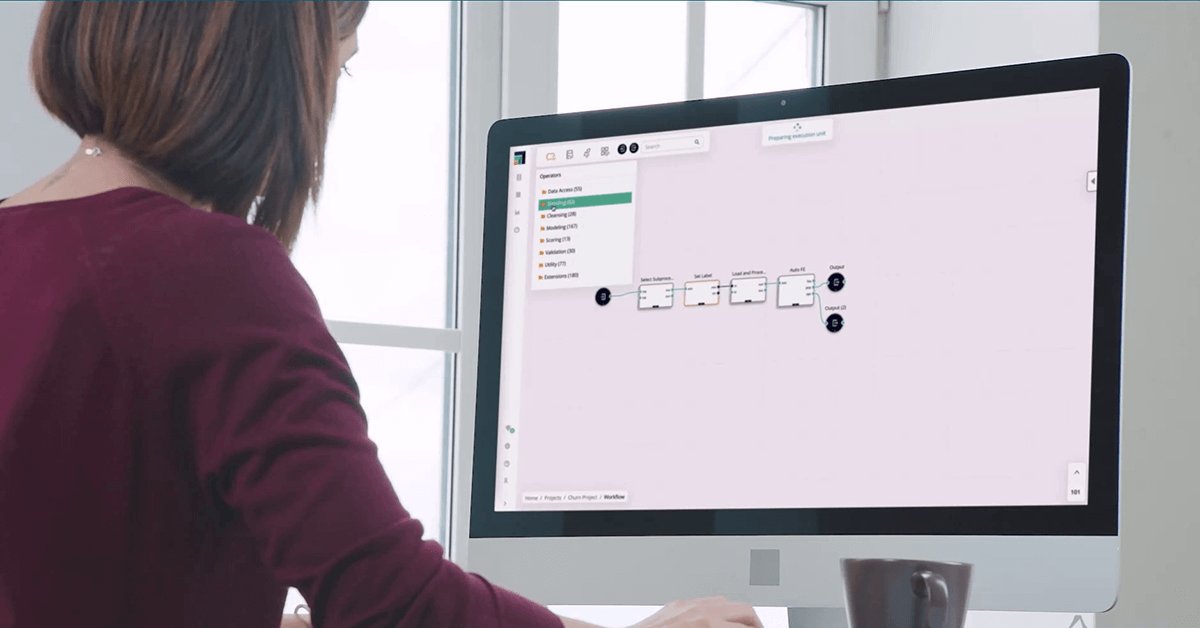

Revolutionize Insurance Risk, Pricing, Fraud, and Application Processing Workflows with Altair® RapidMiner®

The insurance industry is undergoing a transformative phase. Altair RapidMiner’s advanced data analytics tools help insurers extract valuable insights from massive datasets, leading to more accurate risk assessment, improved customer experiences, streamlined operations, and faster innovation. This short video explains how Altair RapidMiner can unlock new opportunities and build a foundation for sustainable, profitable growth in the dynamic landscape of the insurance industry.

Keeping Finances and Data Healthy

As a growing organization, Cape Regional Health System struggled to bring together information from different databases and reports from patient records, insurance providers and other organizations into a comprehensive business analysis for the management team.